Strengthening Trust and Building Resilience: Key Highlights from The Ghanaian Banker 2025

- August 6, 2025

- Posted by: CIB Ghana

- Category: BlogPost

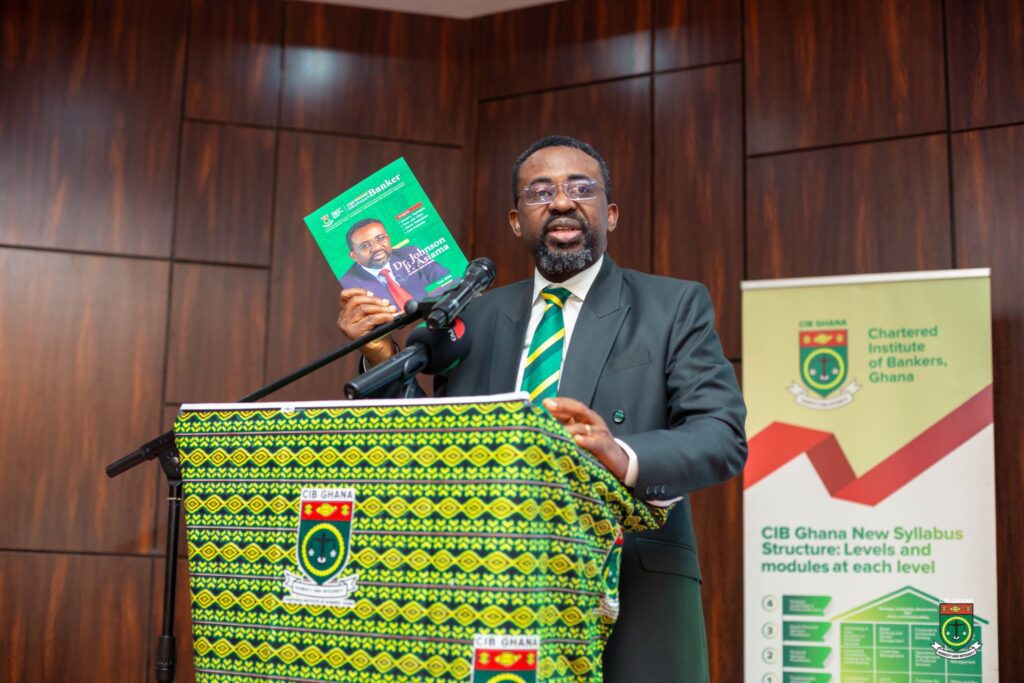

Chartered Institute of Bankers, Ghana (CIB Ghana) is proud to unveil the 2025 edition of The Ghanaian Banker, our flagship annual publication that captures the pivotal developments, expert perspectives, and thought leadership shaping Ghana’s financial sector. This year’s theme, “Resilience in the Financial System: Navigating Horizon Risks,” is both timely and essential as the industry navigates evolving economic conditions, digital transformation, regulatory shifts, and heightened ethical expectations.

A Year of Challenge and Transformation

In his opening address, CIB Ghana President, Mr. Benjamin Amenumey, FCIB, reflects on a year marked by significant tests of resilience, including the Domestic Debt Exchange Programme (DDEP) and a concerning rise in financial fraud. He describes 2024 as a defining period for Ghana’s financial system, where banks were called upon to respond swiftly to liquidity shocks, safeguard customer trust, and reinforce internal controls. Notably, fraud cases increased by 5%, with staff involvement rising by 46%—a clear call for stronger ethical standards across the sector.

Mr. Amenumey urges all industry stakeholders to prioritize proactive risk management, continuous staff development, and a culture rooted in ethics and integrity. These are no longer optional, but essential pillars for sustaining trust and ensuring long-term stability.

Visionary Leadership from the Bank of Ghana

This edition features an in-depth message from Dr. Johnson Pandit Asiama, Governor of the Bank of Ghana, who outlines a six-point reform agenda focused on:

- Strengthening macroeconomic stability

- Enhancing monetary policy tools

- Reforming banking regulations

- Deepening digital transformation

- Promoting financial inclusion

- Improving institutional independence

Dr. Asiama’s focus on cybersecurity, artificial intelligence, and digital financial infrastructure sets a forward-looking agenda for the sector. His commitment to restoring the Bank of Ghana’s financial position and reinforcing policy credibility provides renewed confidence for the industry’s future.

Ethics and Professionalism: The Cornerstones of Trust

Recognizing that trust is the foundation of banking, CIB Ghana continues to champion ethics and professionalism. The Ethics Certification Programme, developed in partnership with the Bank of Ghana, has become a benchmark for all banking staff. The introduction of annual recertification as part of the Bank of Ghana’s “fit and proper” assessment marks a significant regulatory advancement, further safeguarding public trust.

Advancing Leadership Through Education

The 2025 edition also celebrates the success of the Chartered Banker for Executive Leadership (CBEL) programme, which recently graduated its inaugural cohort of 24 senior executives, with a second cohort already underway. This six-month experiential programme is equipping leaders with the skills to navigate complex, high-risk environments.

Additionally, the redesigned Chartered Banker (ACIB) curriculum now incorporates contemporary topics such as digital banking, ESG, customer experience, and governance—ensuring that Ghana’s banking professionals are prepared for the future of finance.

The Sector’s Role in Sustainable Development

Beyond financial performance, The Ghanaian Banker explores the sector’s broader impact on national development. This year’s edition spotlights environmental risk and the challenge of illegal mining (galamsey), emphasizing the critical role banks can play in advancing sustainable finance and supporting projects aligned with the Sustainable Development Goals (SDGs). Initiatives such as CIB Ghana’s Thought Leadership Forum on Climate Finance are guiding institutions toward ESG-focused financing practices.

Economic and Sector Insights

The 2025 edition also provides:

- Analysis of Ghana’s macroeconomic trends and budget outlook

- A comprehensive snapshot of industry performance, including assets, deposits, NPLs, and liquidity

- CEO perspectives from leading banks such as Stanbic Bank and GCB Bank

- Personal reflections from industry leaders on ethics, leadership, and sector transformation

Looking Ahead

As Ghana’s banking sector prepares for the future, The Ghanaian Banker 2025 serves as a powerful reminder that resilience is built through strategic foresight, ethical leadership, and a shared commitment to professionalism. By embracing these principles, Ghana’s financial institutions are well-positioned not only to withstand uncertainty but to shape a stronger, more trusted future.

We invite all members, professionals, and stakeholders to explore the full edition at The Ghanaian Banker 2025.