Certifications

The Institute also runs various certification programmes on core functional areas of the banking industry. Certifications promote credibility, and self-image and encourage lifelong learning and professional development.

Our Certification programme instructs and tests competency outcomes in Technical, Digital, Compliance as well as Behavioral and Strategic skills of participants in the areas of Credit Management, Banking Operation, and Retail Banking to mention but a few.

Our certification programmes are broken down into modules.

The structure of the assessment shall be as follows:

Module 1: Entry

Objectives: Objectives questions carrying (Multiple choice questions and Fill in the gaps) 80marks; and short notes type of questions – 20marks.

Module 2: Intermediate

Objectives: Objectives questions (Multiple choice questions and Fill in the gaps) 60marks, short note 20marks and application questions – 30 marks

Module 3: Advanced

Objectives: Multiple choice questions (Multiple choice questions and Fill in the gaps) 50 marks and application-based questions – 50 marks.

The assessment format of this programme is a weighted measurement of modules.

The average weighted pass mark to qualify is 65%.

Participants who attain the required pass mark will be certified as Experts in the above areas of banking.

Certification Programmes

Our certification programmes are as follows;

Ethics 2.0 Certification

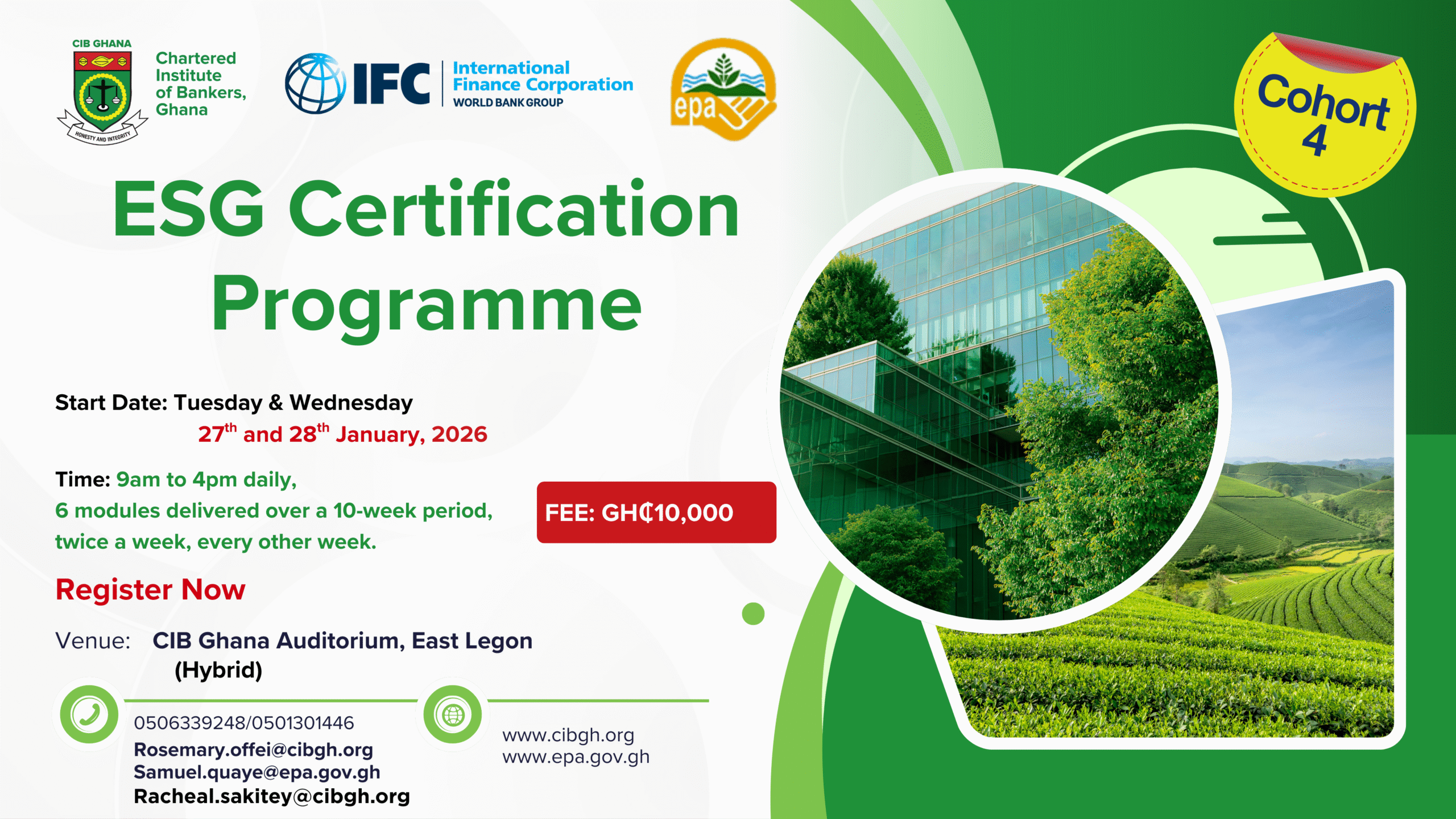

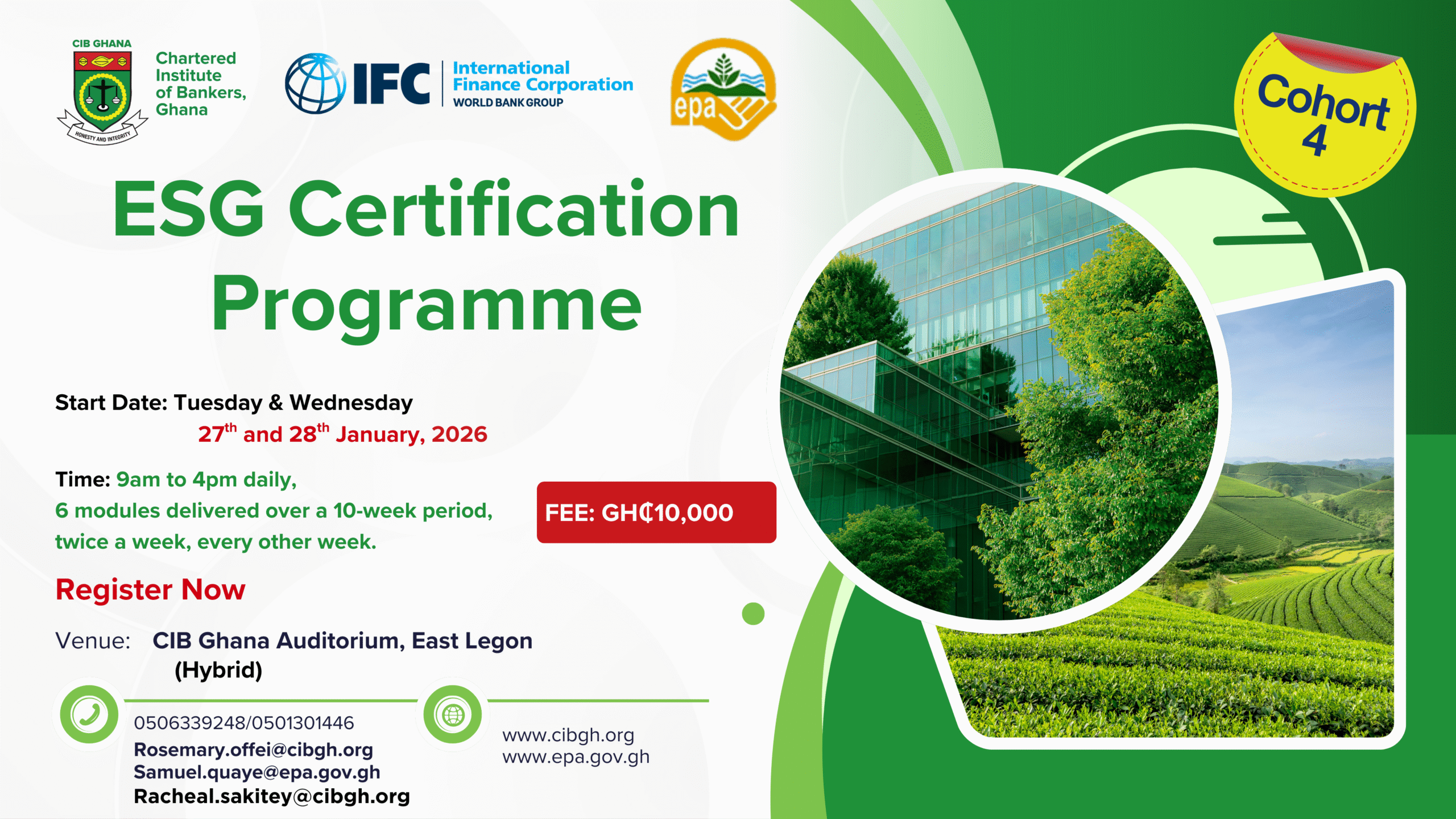

Environmental, Social and Governance (ESG)

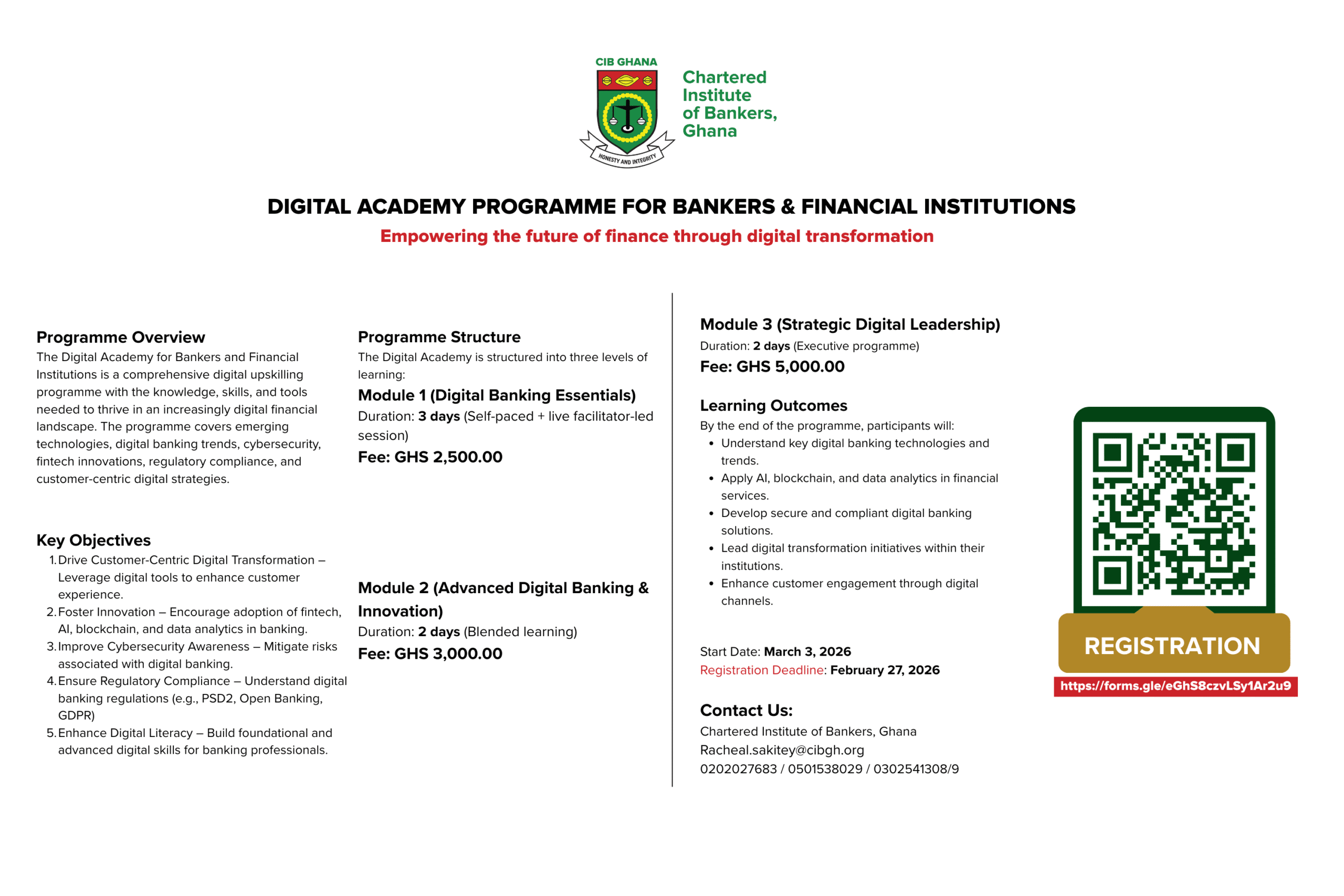

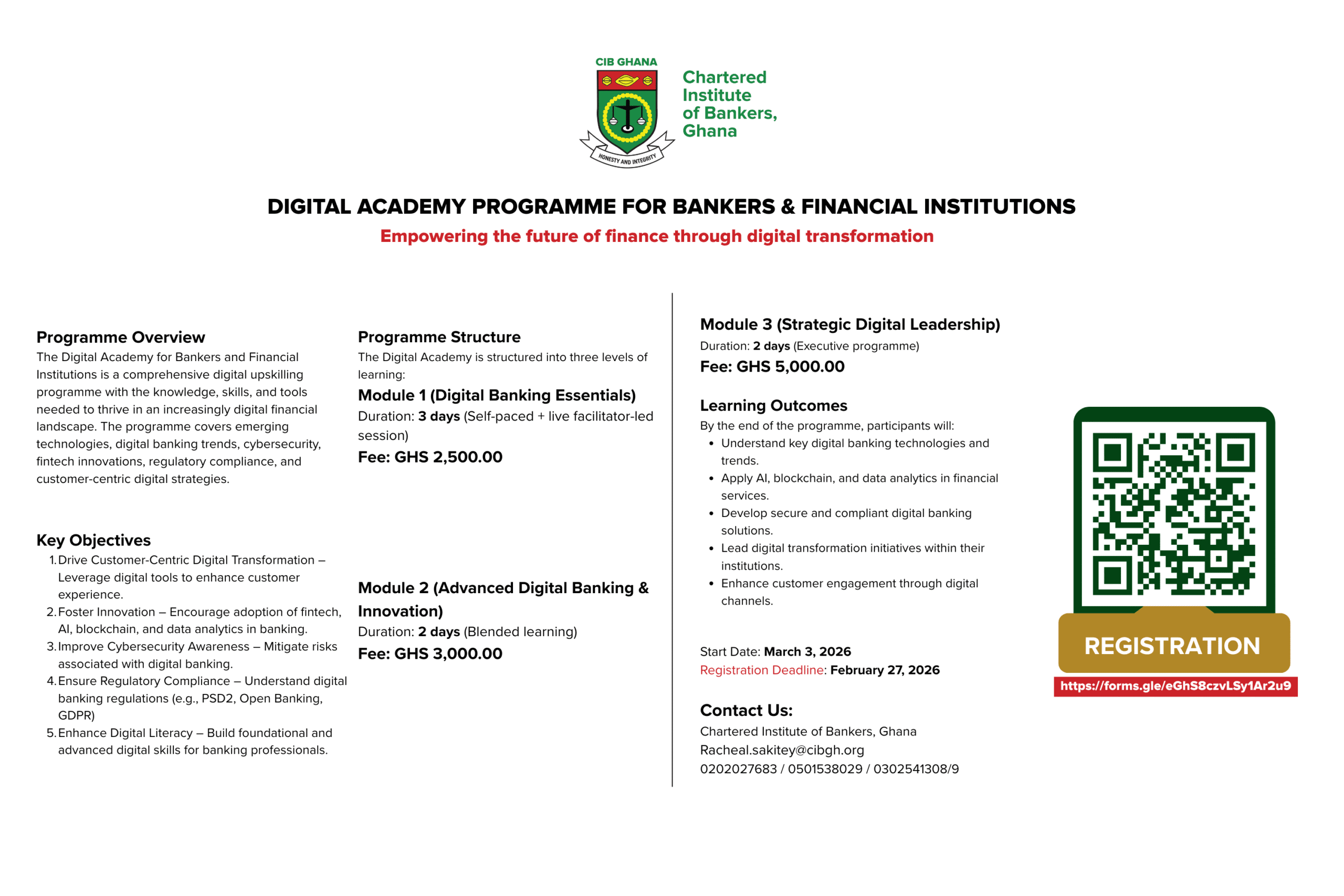

Digital Academy

Non Interest Banking and Finance